contra costa county sales tax by city

You can print a 975 sales tax table here. The Contra Costa County sales tax rate is.

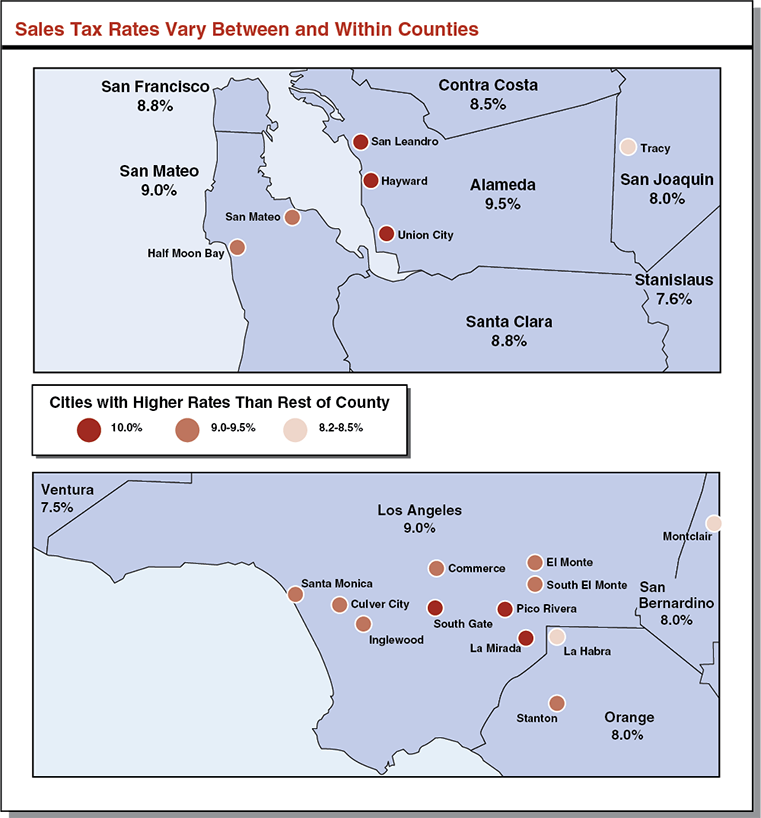

California Sales Tax Rates Vary By City And County Econtax Blog

Peruse rates information view relief programs make a payment or contact one of our offices.

. Brentwood Los Angeles 9500. COUNTY OF CONTRA COSTA DETAIL OF TAX RATES 2017-2018 ROBERT CAMPBELL COUNTY AUDITOR-CONTROLLER MARTINEZ CALIFORNIA. The City Planning and Zoning Department for properties within a city boundary where the property is located and the Contra Costa County Department of Planning and Community Development for properties not within a city boundary can help you determine what use you can make of a tax sale property before you purchase it.

The Contra Costa County sales tax rate is. 1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. Contra Costa County Sales Tax.

Tax rate tra tax rate tra tax rate tra tax rate tra. Triple Flip Unwind PDF Sales Tax Primer PDF 2021. If you are in doubt about the correct rate or if you cannot find a community please call our toll-free number 1-800-400-7115 CRS711 or call the local California Department of Tax and Fee Administration CDTFA office near you for assistance.

Some communities located within a county or a city may not be listed. 1788 rows Contra Costa. Colusa County 750 City of Williams 800 Contra Costa County 850 City of Antioch 900 City of Concord 900 City of El Cerrito 1000 City of Hercules 900 City of Moraga 950 City of Orinda 900 City of Pinole 950 City of Pittsburg 900 City of Richmond 950 City of San Pablo 925 Del Norte County 775 El Dorado County 750.

Who Pays The Contra Costa County Transfer Tax. The 975 sales tax rate in Antioch consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Antioch tax and 25 Special tax. Transient Occupancy Tax Hotel Motel Campground or Bed Tax is authorized under State Revenue and Taxation Code Section 7280 as an additional source of non-property tax revenue to local government.

Oakley City Sales Tax. This tax is levied in Contra Costa County at a rate of 10 for accommodations at facilities in the unincorporated areas of the county. Weve collated all the information you need regarding Contra Costa taxes.

The minimum combined 2022 sales tax rate for Contra Costa County California is. Contra costa measure x 100. Concords overall sales and use tax rate will rise from 875.

Te tax rate changes listed below apply only within the indicated city or county limits. The current total local sales tax rate in Contra Costa County CA is 8750. Contra Costa County Robert R.

California State Income Tax. The December 2020 total local sales tax rate was 8250. California State Sales Tax.

This is the total of state and county sales tax rates. It is based on the propertys sale price and is paid by the buyer seller or both parties upon transfer of real property. 31 rows The total sales tax rate in any given location can be broken down into state county city.

1 7850 to 1330 1m. 2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044. Transfer tax is a tax imposed by states counties and cities on transferring the title of real property from one person or entity to another within the jurisdiction.

Contra Costa County CA Sales Tax Rate. Ad Find Out Sales Tax Rates For Free. The California state sales tax rate is currently.

Contra costa county sales taxes vary by local jurisdiction presently collecting 825 to 975 already. CONTRA COSTA COUNTY 875. City of Angels Camp 775.

Welcome to the Tax Portal. City of Antioch 975 City of Concord 975 City of El Cerrito 1025 City of Hercules 925 City of Martinez 975 Town of Moraga 975 City of Orinda 975 City of Pinole 975 City of Pleasant Hill 925 City of Richmond 975. Contra Costa County Property Tax.

Prime TRA CityRegion Cities 01000 Antioch 02000 Concord 03000 El Cerrito 04000 Hercules 05000 Martinez 06000 Pinole 07000 Pittsburg 08000 Richmond 09000 Walnut Creek. The measure adopts a 05 sales tax for 20 years beginning april 2021. The contra costa county sales tax measure measure x depends on the passage of sb 1349 drafted by sen.

City of Williams 775. For tax rates in other cities see California sales taxes by city and county. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Camino 7250 El Dorado Camp Beale 7250 Yuba Camp Connell 7250 Calaveras Camp Curry 7750 Mariposa Camp Kaweah 7750 Tulare Camp Meeker 8125 Sonoma Camp Nelson 7750 Tulare Camp Pendleton 7750 San Diego.

6 rows The Contra Costa County California sales tax is 825 consisting of 600 California. The city estimates the tax. COLUSA COUNTY 725.

2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 -. City of Fowler located in Fresno County 658. California State Property Tax.

Fast Easy Tax Solutions.

Episode 424 How Much Is A Firefighter Worth Firefighter Fire Trucks Big Trucks

California Public Records Public Records California Public

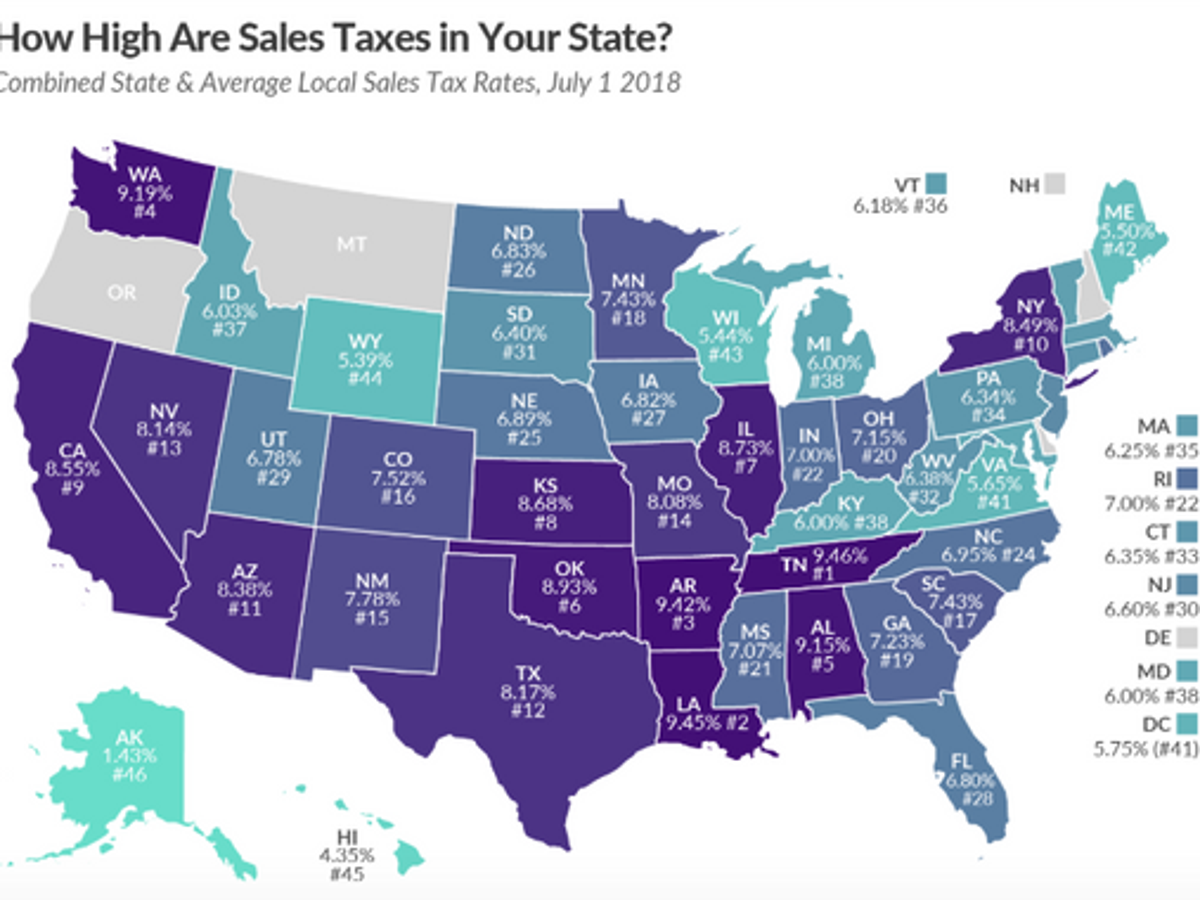

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

1214 Pomona St Crockett Ca 94525 Mls 40902910 Zillow Pomona Port Costa Contra Costa County

Understanding California S Sales Tax

Taxjar Automated Sales Tax Reporting Filing Filing Taxes Tax Sales Tax

Mount Diablo Topo Map Art California State Park Danville Etsy Topo Map Map Art State Parks

Register Nevada Sales Tax Nv Reseller Pertmit Nevada Sales Tax Las Vegas Nevada

Driving A Taxi Marked With Advertisements Permissible Homeowner Real Estate Manhattan Apartment