reverse tax calculator formula

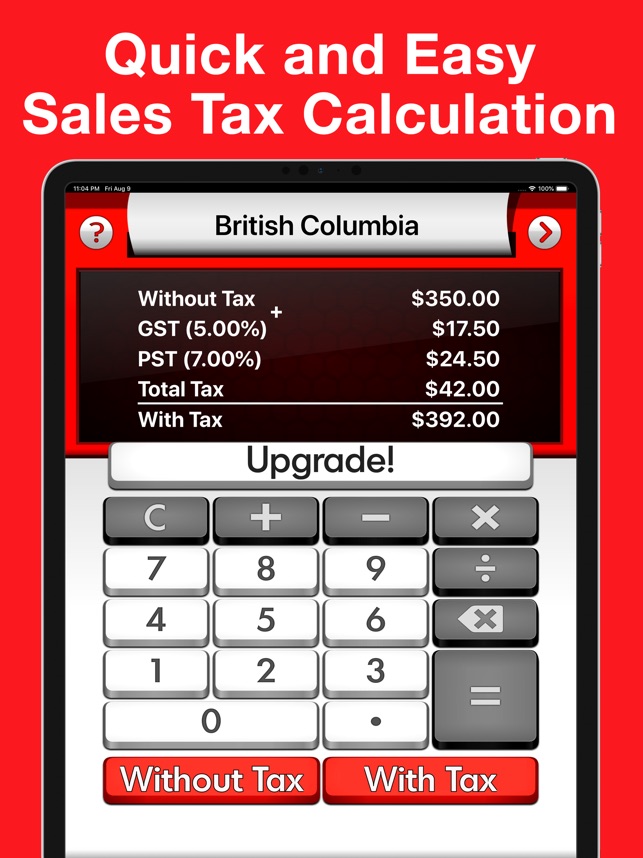

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. This is the NET amount after Tax the.

Sales Tax Calculator Double Entry Bookkeeping

Amount with sales tax 1 HST rate100 Amount without sales tax.

. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax price. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax.

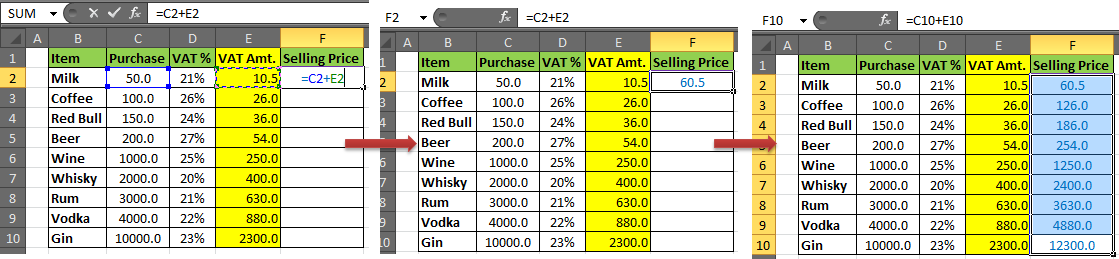

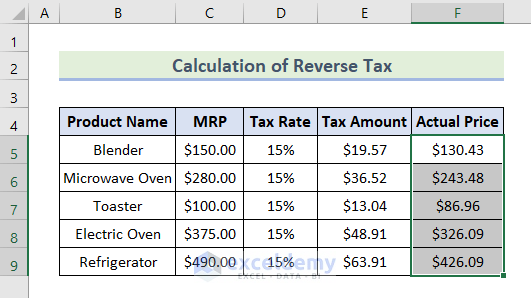

Notice my main language is not English. The following formula can be used to calculate the. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax.

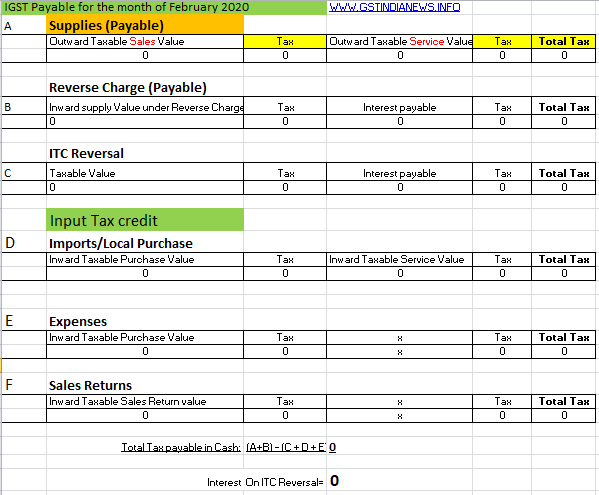

New Brunswick Newfoundland and Labrador Nova Scotia. Reverse Sales Tax Formula. Amount with taxes Canada Province HSTQSTPST variable rates Amount.

How to Calculate Reverse Charge under GST. For your convenience I have included the following mini calculator to find the sales tax rate. Amount with VAT 1 VAT rate 100 Amount without VAT.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Formulas to Calculate Reverse Sales. Do you like Calcul Conversion.

I appreciate it if. Here is how the total is calculated before VAT. Tax reverse calculation formula.

The formula for computing the actual sales price is easy. You can calculate the reverse tax by dividing your tax receipt by 1 plus. To make things simple you can also depend on the reverse percentage calculator.

Amount without sales tax. Pre Tax Price of Product. When a price inclusive the tax is mentioned in such cases reverse tax is applied.

Amount without sales tax x HST rate100 Amount of HST in. 06 r6 100sum p5q5 p6 o6p5. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount.

Reverse Sales Tax Calculations. Calculate the canada reverse sales taxes HST GST and PST. Formulas to calculate the United Kingdom VAT.

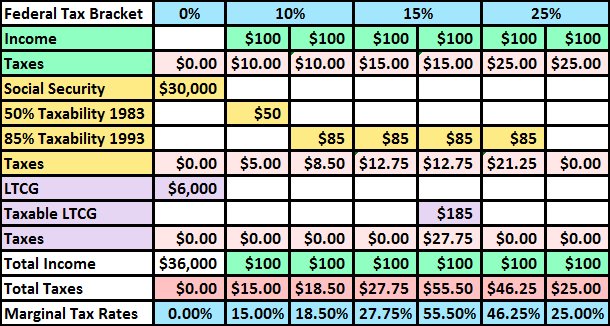

Formula for reverse calculating HST in Ontario. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. X 100 Y result.

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. GST Calculator Good and Service Tax Reverse Sales Tax Formula. Sales tax is calculated by multiplying the sales tax rate by the total pre-tax cost.

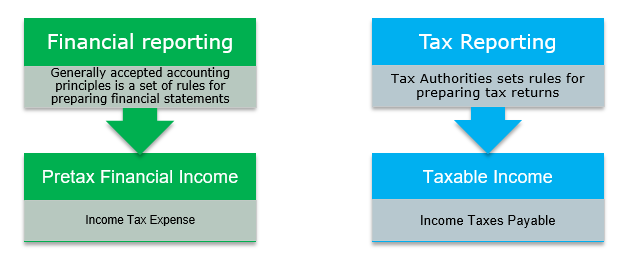

Calculates the canada reverse sales taxes HST GST and PST. Sale Tax total sale. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a.

Collecting Sales Tax Like income tax calculating sales tax often. Net Income - Please enter the amount of Take Home Pay you require. Below mentioned is the formula to use while.

The reverse sale tax will be calculated as following. Here is how the total is calculated before sales tax.

Best Excel Tutorial How To Calculate Gst

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Sales Tax In Excel Tutorial Youtube

Deferred Tax Liabilities Meaning Example How To Calculate

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Gst Calculator Online Formula With Example Excel Sheet

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Here Are The Income Requirements For A Reverse Mortgage

Sales Tax Canada Calculator On The App Store

Effective Tax Rate Formula And Percentage Calculation

Reverse Sales Tax Calculator Calculator Academy

Indian Gst Calculator Gstcalculator Net

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Deferred Tax Liabilities Meaning Example How To Calculate

How Stripe Calculates Tax Stripe Documentation

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Reverse Sales Tax Calculator De Calculator Accounting Portal